In its article titled “Artificial Intelligence’s ‘Bad Data’ Problem for Real Estate Investment,” the Urban Land Institute highlights several challenges of using AI in real estate asset management, most notably the data it relies on. The promise of AI to revolutionize asset management is hampered by data that is not standardized, integrated, or reliable.

For AI and automation to truly reach their potential in the industry – and to ensure high-quality, reliable data – real estate asset management data must be:

- Aggregated

- Standardized

- Normalized

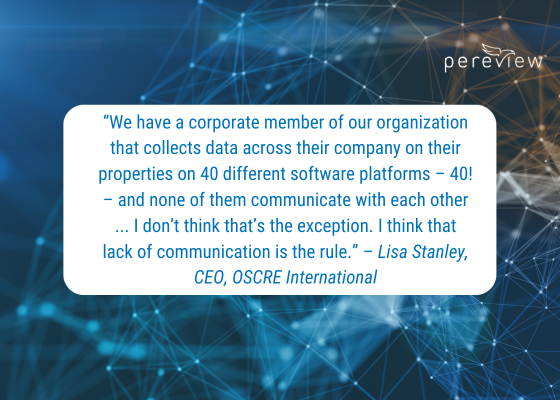

Unfortunately, data fragmentation is pervasive across the industry.

Portfolio and asset managers often receive data from software programs that do not – and cannot – communicate with each other, leading to inconsistencies and inefficiencies. For many real estate asset management firms, there is no option for consolidating data, which leads to inaccuracies and errors that create challenges around both standard and ad hoc reporting.

All of this adds up, making solid business decisions difficult at best – which can significantly impact a firm’s ability to effectively manage its portfolio.

‘Apples to apples’

The ULI article emphasizes a need for “apples to apples” comparisons in data, which is only possible through rigorous data normalization. This is precisely the constant struggle Singerman Real Estate, a Chicago-based investment firm, dealt with in its real estate data management. Tired of this challenge, Singerman decided to solve this quandary with Pereview.

By integrating and normalizing data, regardless of its original format, the platform not only enhances data quality but also significantly improves transparency, allowing real estate asset management firms to make informed decisions with confidence.

Singerman has also taken advantage of Pereview’s 40-plus built-in integrations, AI-powered data ingestion, and data validation performed by its Data Management Services team.

The ULI article also underscores the importance of a long-term commitment to data infrastructure. Pereview has been built with this vision, providing continuous updates and customization to help clients stay ahead of their data challenges and meet their individualized needs.

Consistency is critical

By ensuring data integrity and consistency, Pereview helps real estate firms overcome the “garbage in, garbage out” dilemma that plagues both AI applications and real estate asset management in general.

Simply put, Pereview enables both equity and debt investors with the most flexible, AI-powered commercial real estate asset management platform so they can improve financial performance, visualize risk, and streamline operations throughout the lifecycle for both equity and debt investments.

Want to learn more about how Pereview could help your firm overcome its “bad data” challenges? Click below to schedule a quick 15-minute conversation.