Commercial real estate’s most flexible asset management platform for both equity and debt

Empower your front office with one solution for optimizing financial performance, visualizing risk, and automating repetitive tasks

Portfolio and Asset Managers

Manage equity and debt in one platform across the life of the asset™

The first of its kind, Pereview is the commercial real estate industry’s only asset management platform for managing equity and debt investments. It gives you visibility into the health of your entire business down to individual assets so you can see critical KPIs like NOI, IRR, LTV, DSCR, AUM, occupancy, leases, loan performance, maturity dates, and much more with the convenience of point-and-click and ad hoc reporting, yet flexible enough to be customized to the way you do business. That’s the power of Pereview.

Empower asset managers with Pereview

Leverage the power of the fastest growing real estate asset management platform

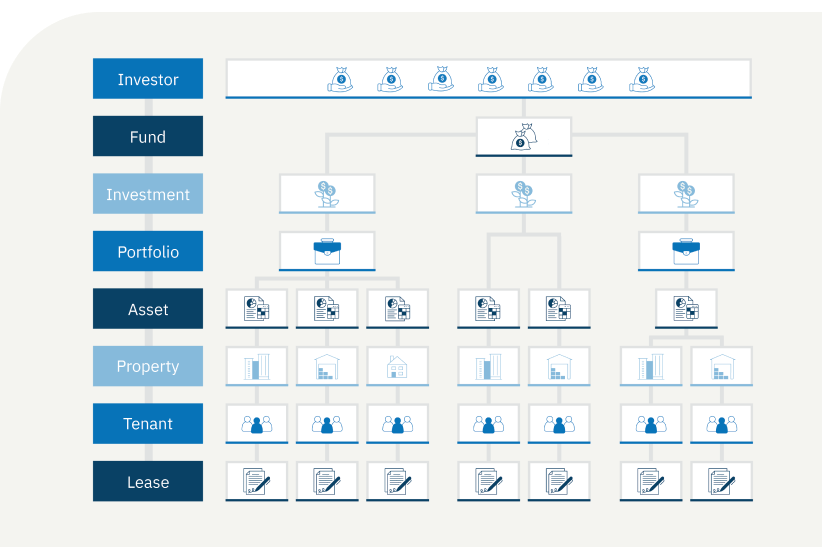

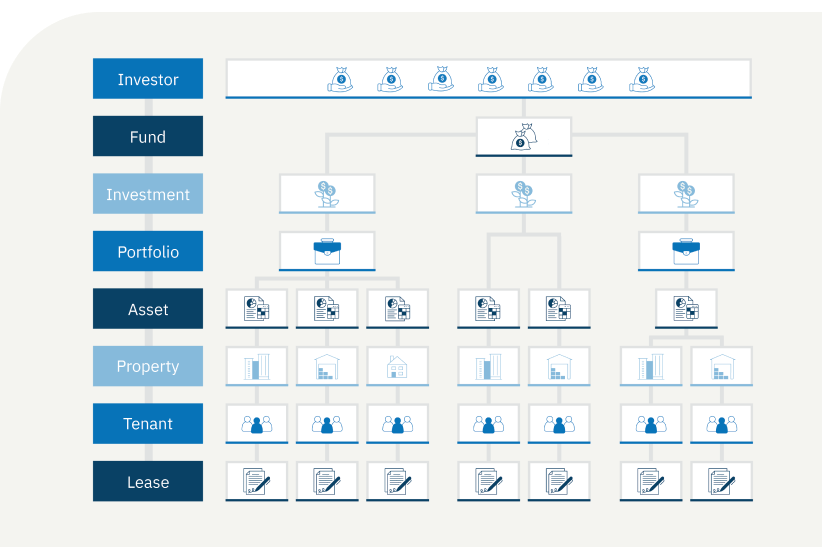

Fund to the lease intelligence

From the fund to the lease, instantly see performance and risk with the industry’s most advanced data model

Dashboard-level reporting informed by single-source-of-truth data aggregation for the entire business is powerful. Pereview provides insight into critical metrics throughout the investment hierarchy.

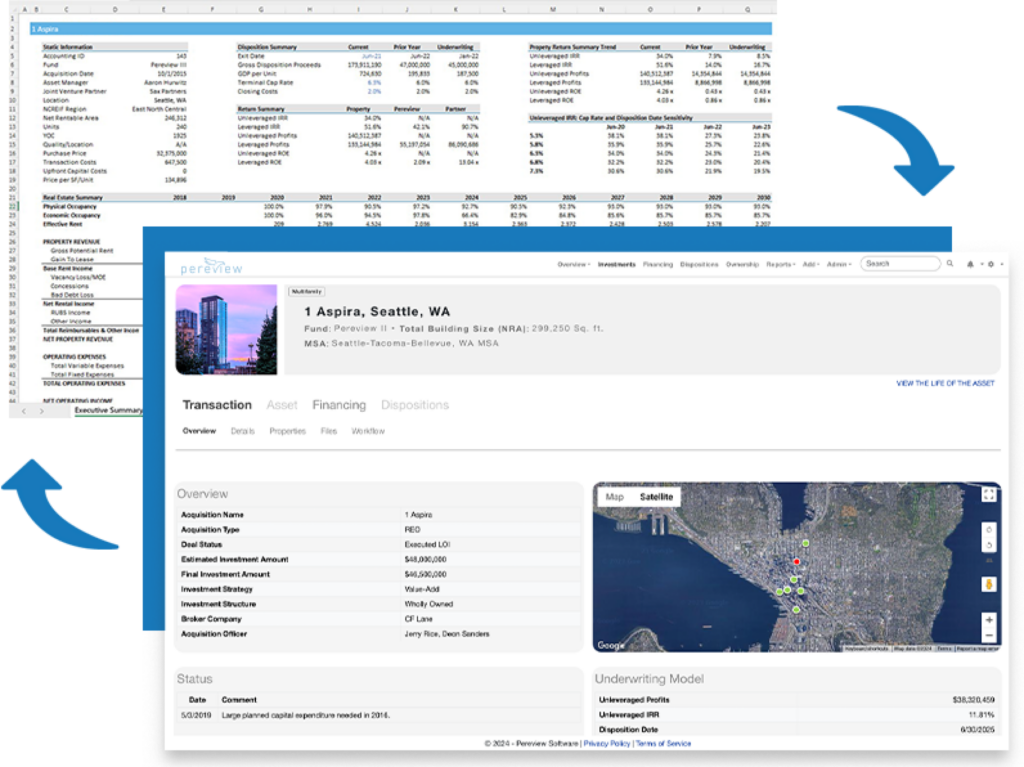

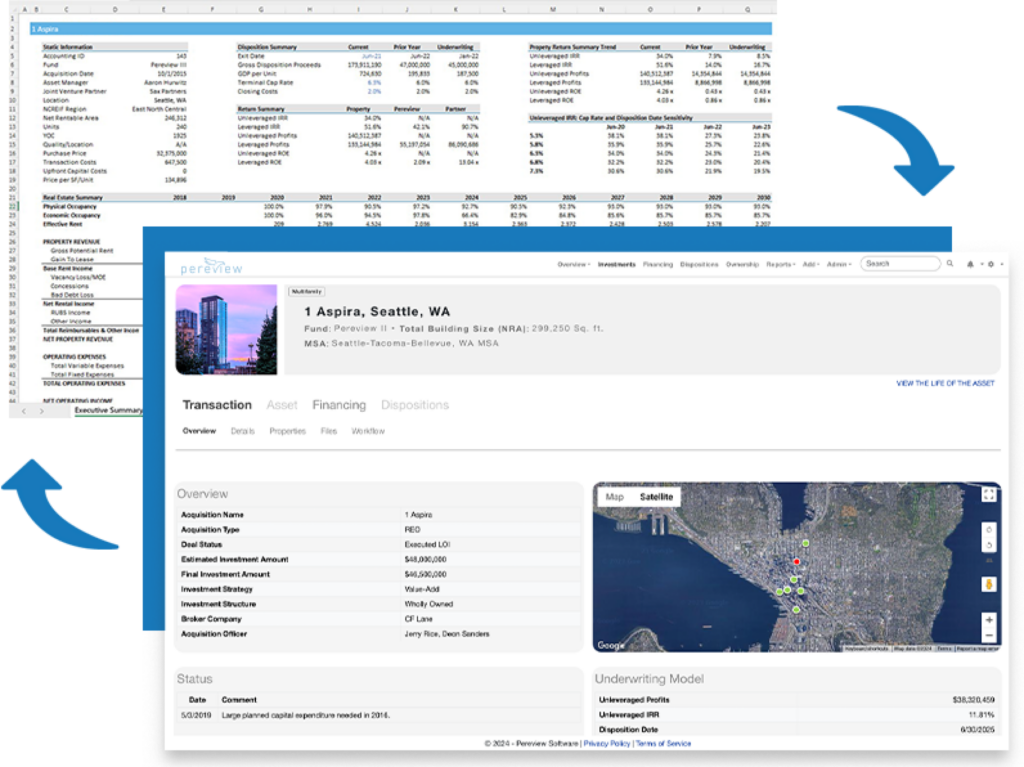

Excel model connection

Visualize key metrics informed by connecting Excel models to Pereview

Pereview connects your Excel models to the Pereview database allowing for centralized storing of your underwriting assumptions and cashflows. Once the data is centralized in Pereview, reporting on underwriting projections vs. actual performance is one click away.

Ad hoc reporting with Power BI

Transform your portfolio data into flexible, on-demand reports

Pereview empowers you to build reports on the fly with Power BI. Drill into financials, track key dates, analyze loan schedules, or monitor occupancy trends, all without waiting on IT or Pereview Support. Explore your portfolio data with speed, flexibility, and confidence.

Data integration

All your data in one place, automatically

All this insight is fueled by data from industry standard accounting systems like Yardi, MRI, OneSite, QuickBooks, Sage, Entrata, AppFolio, and more. In addition, we consume other data sources including: Juniper Square, DealCloud, DealPath, Chatham, Investran, STR, eFront, NCREIF, and other sources utilizing a robust library of 100+ prebuilt integrations.

Third-party access

Third-party property management companies and borrowers can input their own data into Pereview

You can also extend Pereview to third-party Property Management Companies (PMCs), borrowers, and others in your ecosystem so they are able to input financial, operational, and variance data into Pereview. Then you can manage and communicate seamlessly within the platform for one source of truth.

AI-powered data

AI data ingestion

Including the following;

- Rent rolls and trial balances

- Offering memorandums

- JV agreements

- Loan and lease abstracts, and more

Workflow automation

Powerful custom workflows

Automate manual, repetitive tasks for one-and-done convenience. Workflows are flexible to align with the way you do business and can be customized to automate reviews and approvals from Property Management Companies and internal stakeholders.

- Create workflows at an asset, fund, and portfolio level based upon your business needs

- Use workflows to automatically request monthly reviews of financial reports

- Track asset-level decisions across teams such as accounting, analysts, asset managers, and managing directors

Data services

Empower asset managers to invest their time in performance optimization, rather than techie tasks

The value of Pereview’s asset management platform from the perspective of your peers

We intend to utilize the full capabilities of Pereview to increase internal efficiencies by automating the aggregation of our trusted data into a centralized database, integrate with our forecasting and valuation models, and enable expedited business intelligence and reporting across all of our real estate portfolios.”

From the start of fundraising to investor reporting, from portfolio analysis to strategy at the asset level, all the way down to industry exposure and lease clauses – all of our data, across the entire investment lifecycle, is supported.

We now spend more time doing deeper investment analysis allowing us to drive value creation across our portfolio versus spending time updating many Excel files to answer the same set of questions over and over again.

Pereview and Juniper Square have been a game changer for us. We’ve been able to support the growth of our platform and materially increase portfolio analytics capacity without having to grow the team significantly.”

Pereview and Barings work closely with each other to consistently enhance our experience either by adjusting/adding new reports and/or recommending new features and functionality to be built.

Pereview easily added at our request the ability for our domestic and international PMCs to log in via securities to manage monthly variance explanations creating a huge efficiency to our team.”

How, may you ask?

With Pereview, the monthly import of financial data requires our partners to lock down their financial statements (changes communicated or statements will not balance.) Instead of partners making financial changes after submission, partners send updated reports (Trial Balances) which load into Pereview. Since the partner’s general ledger accounts map to our general ledger in Pereview, the data is loaded, reconciled, and prepared into our formatted financial statements.

Thus, our 100+ partners now submit financial data from numerous systems. Since Pereview is agnostic, the various partner trial balance loads into Pereview and are then automatically mapped. Pereview produces reports in our financial format, and comparative analysis is completed with no manual intervention from our analysts.

Senior Leadership has complete confidence in the system, and our financial analysts analyze the data instead of manually entering data into spreadsheets.”

You can work with anyone or any system to get our data in one place.

Honestly, that is probably your biggest advantage … you are not trying to force clients into a larger tech ecosystem like everyone else.

We can use whatever systems makes sense for us and you can bring it all together per our specific requirements.”

Pereview's innovation & leadership

Pereview's innovation & leadership

One Platform

for the entire investment lifecycle

Equity & Debt

in one asset management solution

In

+

Countries

SOC 2

TYPE II

Certified

+

Property Types

CRE real estate portfolio and asset management best practices and insights

As liquidity tightens and hold periods extend, lenders are demanding cleaner, faster, more defensible data – and most firms aren’t ready The private markets liquidity landscape is changing. Traditional exit timelines have slowed, rates remain elevated, and

Debt as an asset: Navigating refinancing risk and opportunity in 2026

CRE’s “tale of two debt markets” is unfolding – and data visibility will decide who benefits. According to Deloitte’s 2026 Commercial Real Estate Outlook, the debt markets are splitting in

The middle office is becoming a strategic growth engine for modern CFOs

Why private markets firms are rethinking their operating models – and how a unified data platform unlocks new efficiency, transparency, and scale For decades, private markets firms have treated the middle

Evergreen & private wealth funds are rising fast – but most firms aren’t operationally ready

Why the shift toward private wealth is accelerating – and why operational infrastructure will determine who wins this new capital channel The private markets fundraising landscape is shifting underfoot. While institutional capital remains foundational, the