At the recent IMN CRE Asset Managers’ Forum, our Founder and CEO Jeff Wilson shared his point of view on the effect of technology adoption in asset management in the panel discussion, “The Latest Tech Trends and Improving AUM Analytics & Reporting.”

As Jeff and other industry leaders shared, heavy dependence on Excel remains within asset and portfolio management – even among the most sophisticated firms.

- Despite the emergence of new technologies, many firms continue to depend on Excel for managing crucial portfolio and asset data.

- While there have been strides in areas such as financing and loans, the overall adoption of advanced technology in real estate asset management has been slow.

- Many teams still use bespoke solutions and ad-hoc tools to pull data into new systems, often relying on Excel as a stopgap.

The issue with this approach is that while Excel is a versatile tool that shines for modeling, relying too heavily on Excel for data management creates and magnifies inefficiencies as data volumes grow and portfolios become more complex.

Asset managers find themselves spending excessive time cobbling together reports from multiple data sources manually, often resulting in inconsistencies and missed insights.

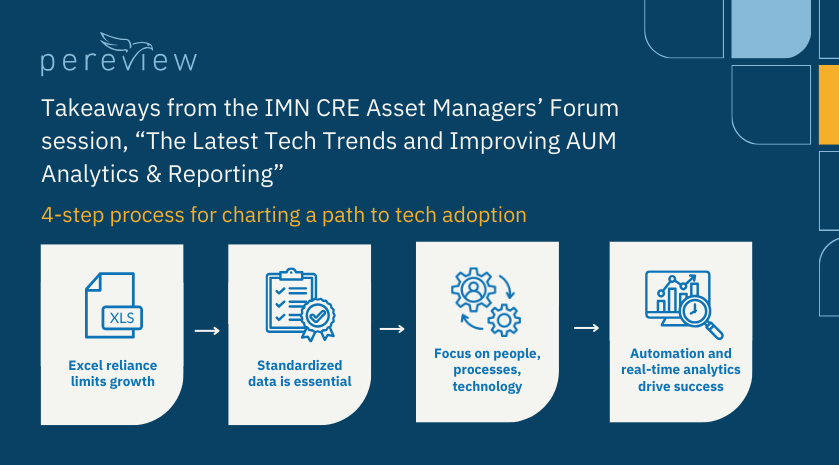

A major obstacle to moving away from these manual processes is the lack of standardized data across the industry. Without standardization, it’s difficult – if not impossible – to integrate new technologies effectively, leaving firms tied to fragmented, piecemeal solutions that prevent them from fully optimizing their workflows.

Three key building blocks for a successful transition to modern asset management

To truly drive success in real estate asset management, firms need to focus on three essential pillars: people, processes, and technology – in that order. The right technology can transform operations, but without the right people and processes in place, even the most advanced software will fall short.

- People: The success of any technology depends on the people who will use it. However, firms that hire professionals with both real estate asset management expertise and digital literacy will be better equipped to leverage technology to drive smarter decisions and optimize performance.

- Processes: Before introducing new technologies, asset management processes must be clearly defined and standardized. Better processes lead to better data, and by refining workflows, firms can more easily adopt new tools.

- Technology: Once people and processes are aligned, technology can become a true catalyst for transformation. Real-time data analytics and automated reporting capabilities are just two of the technologies that can transform asset management.

This is where Pereview plays a pivotal role. With Data Management Services, our data validation experts format, normalize, and align data with Pereview. This service complements automated workflows, AI-powered data ingestion, and direct integration with source systems for data to address all three of these crucial pillars in a single platform for both equity and debt.

The path forward

The future of real estate asset management lies in the integration of people, processes, and technology. Firms that focus on empowering their teams, standardizing their workflows, and embracing the right technology will be well-positioned to thrive in an evolving and competitive industry.