Asset managers can automate routine tasks, streamline reporting, and more with Pereview

Modern Asset Management Video Series

former Goldman Sachs Archon Group

Four common commercial real estate data management challenges

Overcoming them may be easier than you think

Simplify your CRE tech stack with one platform for the entire investment lifecycle

Pereview enables you to aggregate, normalize, and validate data from 100+ CRE software programs, internal stakeholders, Joint Ventures (JVs) and Property Management Companies (PMCs). The platform’s point-and-click dashboards, reports, and data visualizations show you where you stand on key KPIs and metrics instantly for every stage of the investment lifecycle.

Acquisition

Manage deal pipeline

Underwriting

Connect your underwriting Excel models

Financing

Understand debt-related KPIs

Closing

Closing checklists and workflows

Asset Management

Optimize performance and visualize risk

Portfolio & Fund Management

Insight into overall fund performance

Disposition

Manage disposition process

How Pereview makes it easier to manage commercial real estate equity investments

Powerful features unmatched in the industry

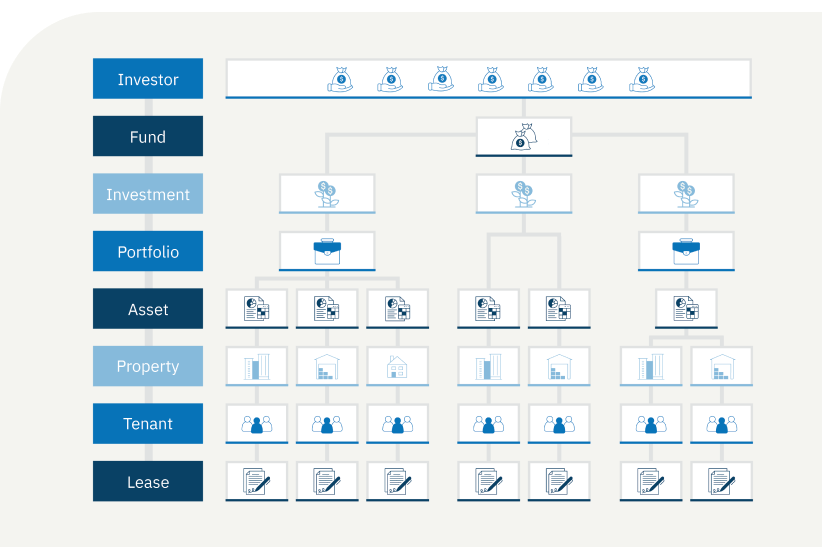

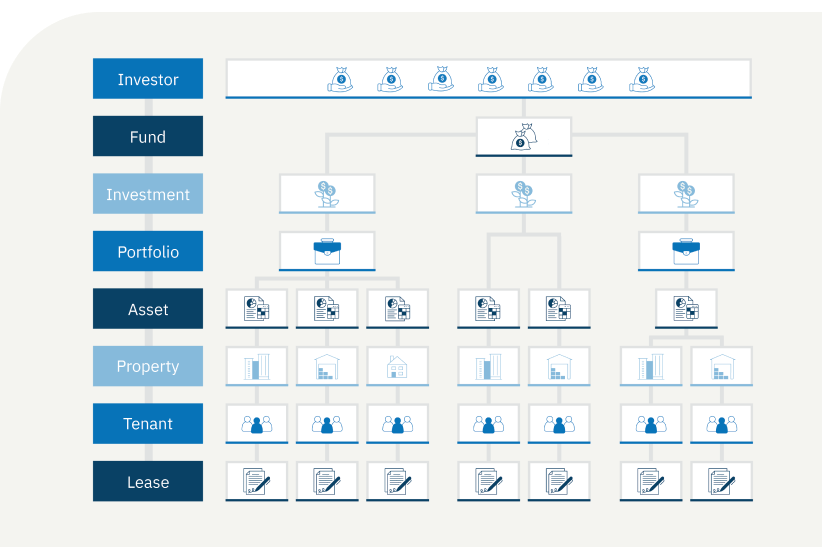

Fund to the lease intelligence

Performance and risk insights from the fund to the lease

Answer investor and internal stakeholder questions with confidence at every level of the investment hierarchy with the platform’s prebuilt, ad hoc, and custom reports built to your specific requirements.

View multiple dimensions on key metrics at the business, fund, portfolio, or asset level down to individual lease performance so you can make informed decisions faster with less effort.

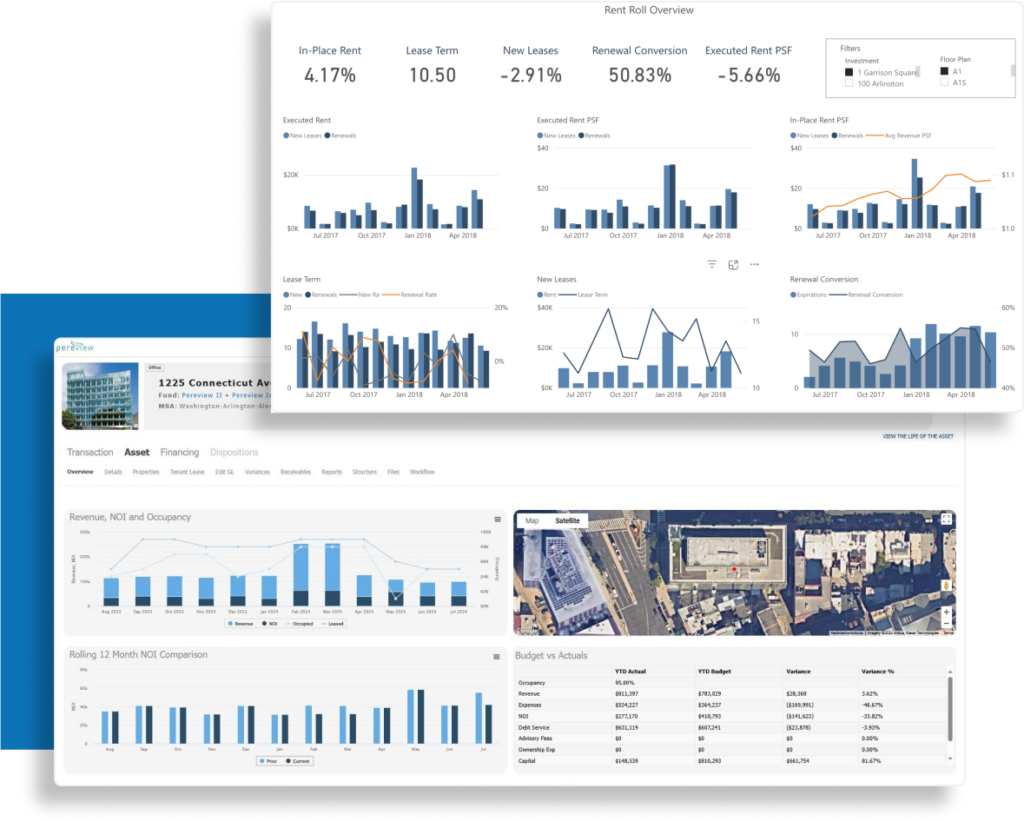

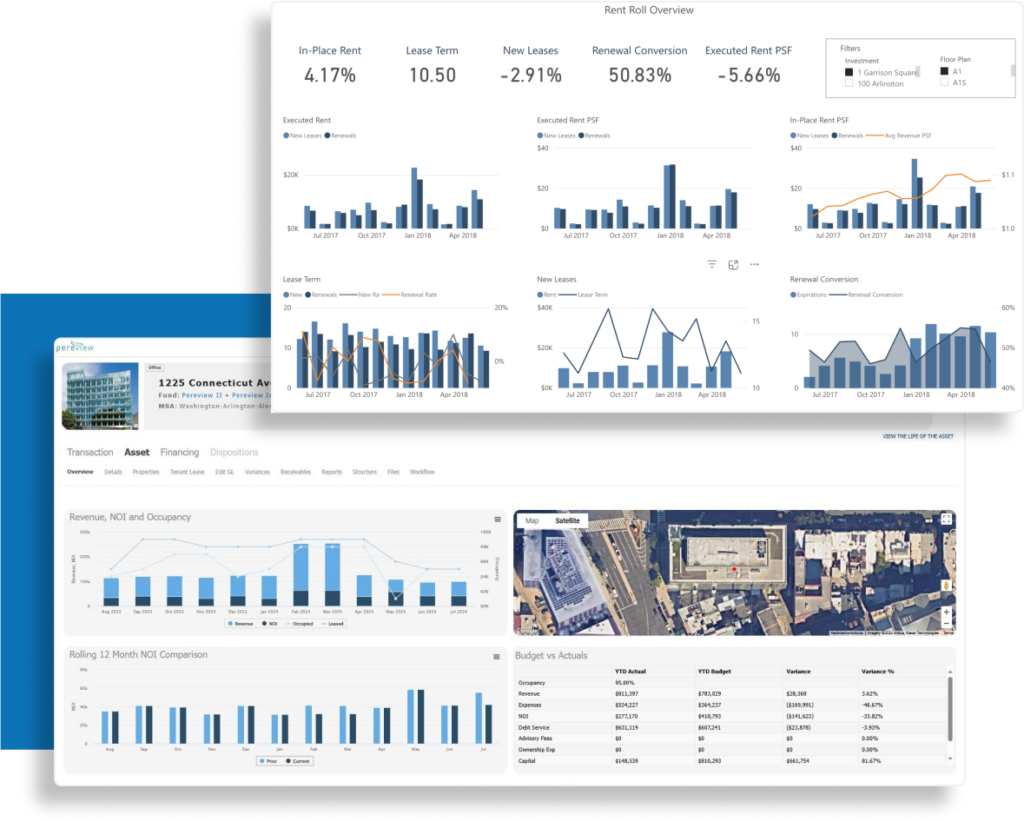

Executive-level dashboards and reports

Critical asset management metrics and KPIs in an instant

With an extensive library of pre-built reports, Pereview maximizes the value of your asset management platform. At go-live on the platform, executive-level dashboards allow you to instantly visualize critical metrics and KPIs for funds, portfolios, and assets, with automatic data updates from systems like Yardi, MRI, OneSite, Entrata, Sage, and many more.

Additionally, Pereview’s point-click reporting can save up to 90% of the time spent on monthly, quarterly, and annual reports, while delivering them to investors in the format they expect.

Instantly view key performance metrics like:

- Revenue, NOI, Occupancy

- NOI period over period comparisons

- Budget to actuals comparisons

- Stacking plans

- Variances

- Receivables

- Cash flow

- Rent roll details

- Ownership structure

- And more

Complex reporting

Create and analyze complex reports in one click

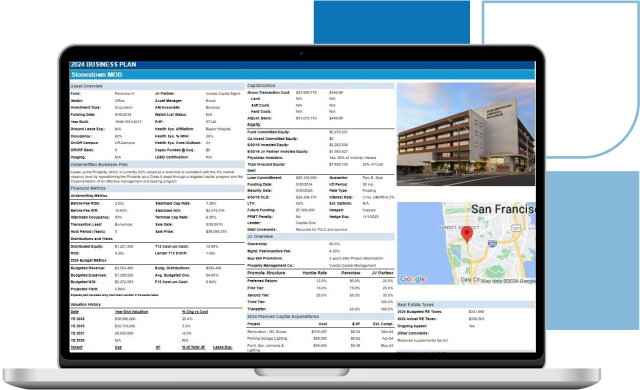

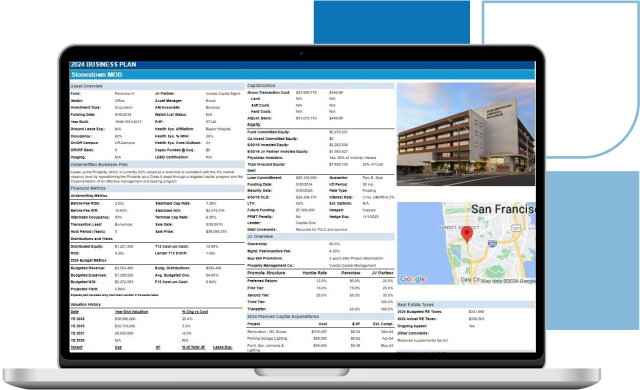

Generate complex reports like business plans, budgets to actuals, underwriting-actuals-valuations variance reporting, quarterly asset management reports, and acquisition pipeline reports instantly.

- Business plans

- Asset performance trend reports

- Performance versus underwriting

- Asset management reports by fund and investment sector (i.e. industrial, multi-family etc.)

- Perform ad hoc reporting with Power BI in Pereview and much more

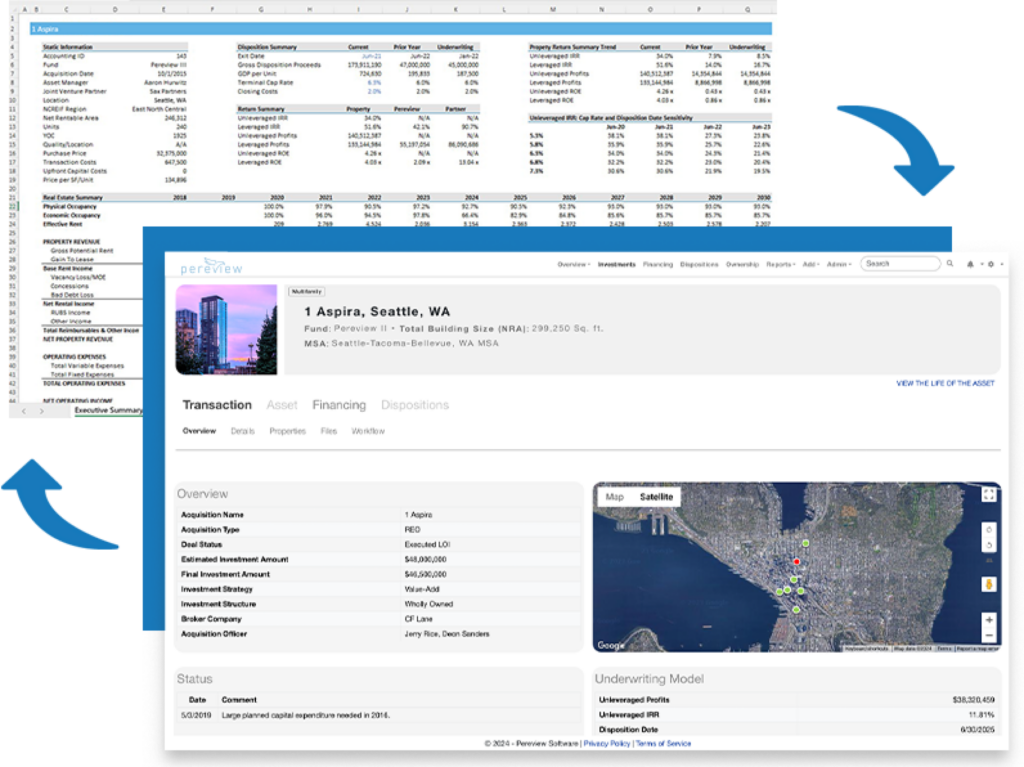

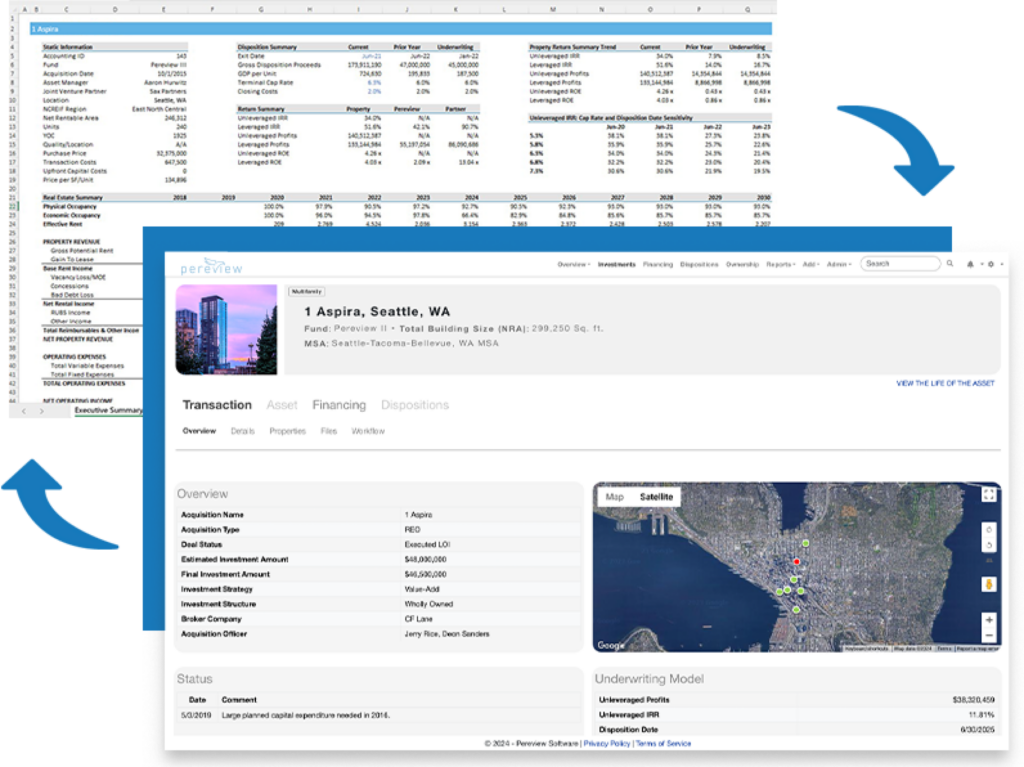

Excel model connection

Visualize key metrics informed by connecting Excel models to Pereview

By connecting your Excel models to the Pereview platform, updates that are made are automatically populated and informed by external data streams from common financial platforms, data providers, and institutions. Experience the convenience of push-button reporting for critical metrics like leveraged and unleveraged IRR, DSCR, LTV, Underwriting to Actuals, and more.

Workflow automation

Powerful custom workflows

Automate manual, repetitive tasks for one-and-done convenience

Workflows are flexible to align with the way you do business and can be customized to automate reviews and approvals from Property Management Companies and internal stakeholders.

- Create workflows at an asset, fund, and portfolio level based upon your business needs

- Use workflows to automatically request monthly reviews of financial reports

- Track asset-level decisions across teams such as accounting, analysts, asset managers, and managing directors

AI-powered data

AI data ingestion

Pereview leads the industry in real estate data management, and our AI capabilities are transforming the way you handle your data. We are using AI to accelerate data load, processing, and validation so your platform instance is always up-to-date and accurate.

Data management services

Empower asset managers to invest their time in performance optimization, rather than techie tasks

The world of CRE investing is fast-paced and ever-changing. That’s why when asset managers spend large portions of their day collecting and organizing data from Property Management Companies (PMCs), Joint Ventures (JVs), Operating Partners (OPs), borrowers, and internal teams, their attention is divided. We understand this challenge, which is why we created Data Management Services and Middle Office Services to reclaim valuable time.

PMC Access

Enable third-party Property Management Companies to update information directly in the platform

Property Management Companies (PMCs) can submit data such as rent rolls, trial balances, and variance explanations in their native format to the platform with security permissions allowing for access only to the properties they manage and with chart of accounts mapped to a master.

Securing your data is our top priority

At Pereview, we prioritize your data security with rigorous encryption protocols including SOC2 Type II attestation, role-based access controls, and comprehensive training on user access management, ensuring your trust is our top priority throughout our seamless onboarding and support processes.

CRE real estate portfolio and asset management best practices and insights

Why co-sourcing is rising – and how a unified data platform solves the accuracy, workflow, and communication challenges between GPs and fund administrators. Outsourcing fund administration has become standard

The rise of the modern private markets CFO: From financial steward to strategic operator

Why the CFO role is expanding, and how data, automation, and middle-office modernization are defining the next era of leadership. Private markets are experiencing one of the most

As liquidity tightens and hold periods extend, lenders are demanding cleaner, faster, more defensible data – and most firms aren’t ready The private markets liquidity landscape is changing. Traditional exit timelines have slowed, rates remain elevated, and

Debt as an asset: Navigating refinancing risk and opportunity in 2026

CRE’s “tale of two debt markets” is unfolding – and data visibility will decide who benefits. According to Deloitte’s 2026 Commercial Real Estate Outlook, the debt markets are splitting in