Gain actionable insight into risk exposure and seamlessly manage debt assets with Pereview

Achieve more throughout the life of the loan

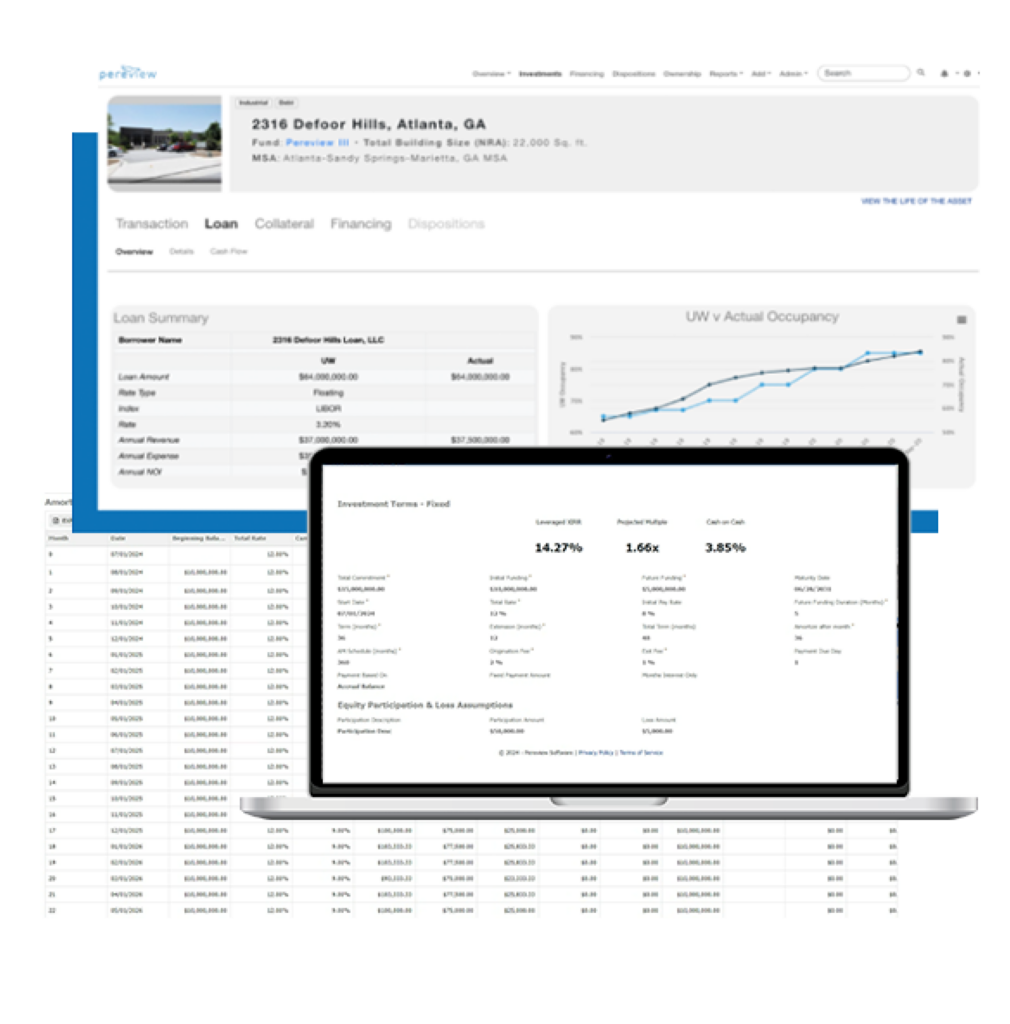

Commercial lending is dynamic. Managing varying loan types and terms, maturity dates, floating interest rates, caps and collars, and borrower compliance is manageable at the loan level, but not at scale. Pereview solves these challenges by enabling you to aggregate, normalize, and validate data from borrowers. Its point-and-click dashboards, reports, and data visualizations show you where you stand on key KPIs and metrics instantly for every stage of the loan lifecycle.

Origination

Underwriting

Financing

Closing

Asset Management

Portfolio & Fund Management

Maturity

How Pereview makes it easier to manage commercial real estate debt investments

Powerful features unmatched in the industry

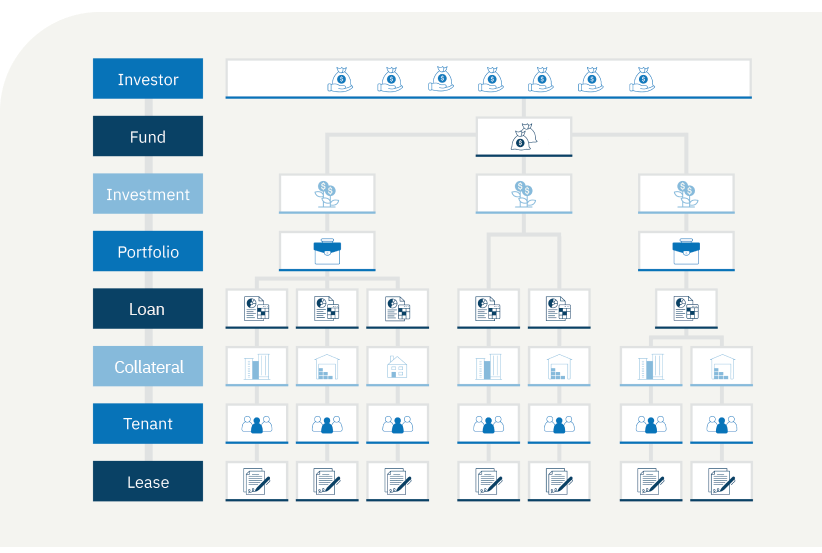

Fund to the loan intelligence

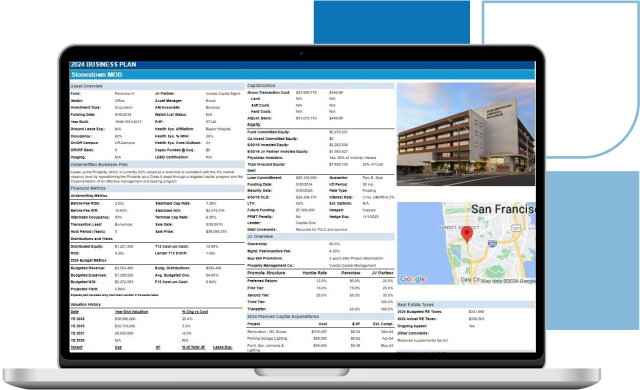

Performance and risk insights from the fund to the loan

View multiple dimensions on key metrics at the fund and portfolio level down to individual loan performance so you can make informed decisions faster with less effort.

Visualize these metrics in dashboards and reports. With over 50 push-button reports, unlimited ad hoc reports, and the flexibility to support your business’s unique underwriting models, you’ll be able to answer LP, investor, and internal stakeholder questions with confidence at every level.

Pre-built and ad hoc reports

Improve productivity and performance with pre-built and ad hoc reports for loans

Visualize key KPIs and metrics with push-button reporting on common criteria, including the following:

- Debt investments including Senior, Mezz, Construction, Debt as Equity, etc.

- Interest-only loans, amortizing loans, fixed and floating rate loans

- Generate both leveraged and unleveraged cashflows

- Interest rate data uploads

- Capture all covenants and key terms

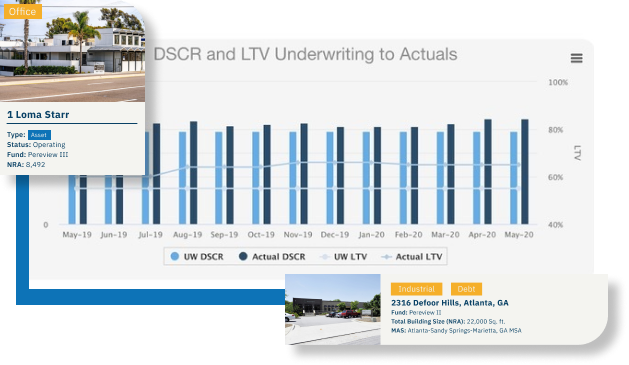

- Advanced reporting on covenants (DSCR, LTV, LTC, etc.)

- Collateral property / portfolio financial and operational data

- IRR and performance metrics / reporting and fund tracking

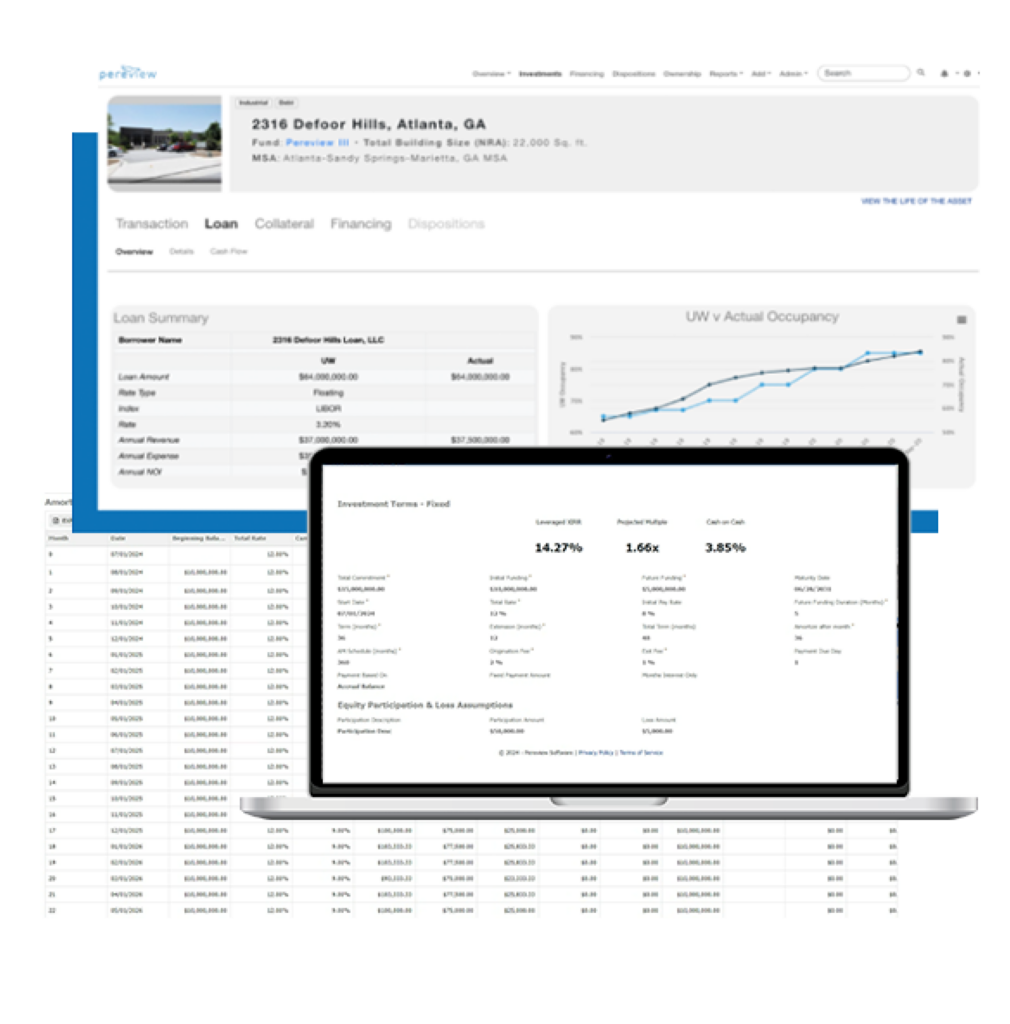

- Amortization schedules, Leveraged XIRR, Projected Multiple, Cash on Cash returns, and more

Complex reporting

Create and analyze complex reports in one click

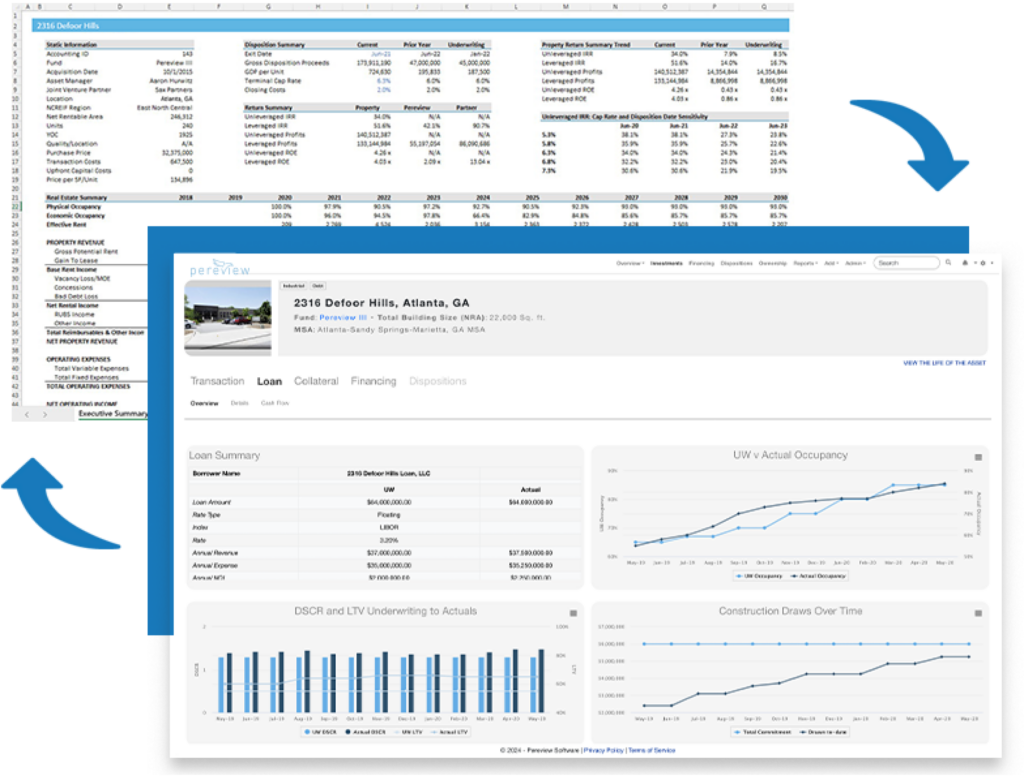

Generate complex reports like loan performance dashboards, covenant compliance tracking, underwriting-to-actuals variance, quarterly portfolio management reports, and debt pipeline summaries instantly.

- Covenant compliance and breach monitoring (DSCR, LTV, LTC, etc.)

- Loan performance trend reports across senior, mezz, bridge, construction debt, and more

- Collateral property performance tracking

- Performance versus underwriting and projected cashflows

- Portfolio and fund-level reporting by loan type, borrower, and sector

- Ad hoc analysis with Pereview Power BI to drill down by borrower, maturity, or collateral property

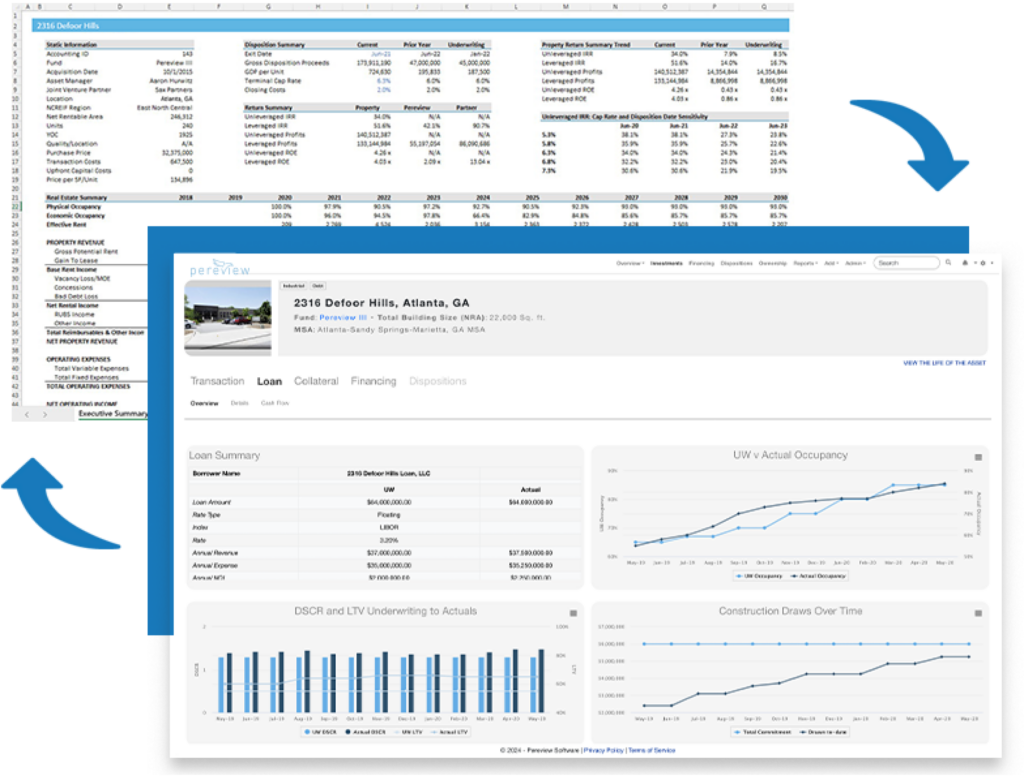

Excel model connection

Visualize key metrics informed by connecting Excel models to Pereview

Pereview connects your Excel models to the Pereview database allowing for centralized storing of your underwriting assumptions and cashflows. Once the data is centralized in Pereview, reporting on underwriting projections vs. actual performance is one click away.

AI-powered data

AI data ingestion

Pereview leads the industry in real estate data management, and our AI capabilities are transforming the way you handle your data. We are using AI to accelerate data load, processing, and validation so your platform instance is always up-to-date and accurate.

Workflow automation

Powerful custom workflows

Automate manual, repetitive tasks for one-and-done convenience

Workflows are flexible to align with the way you do business and can be customized to automate reviews and approvals from Property Management Companies and internal stakeholders.

- Create workflows at an asset, fund, and portfolio level based upon your business needs

- Use workflows to automatically request monthly reviews of financial reports

- Track asset-level decisions across teams such as accounting, analysts, asset managers, and managing directors

Data management services

Empower asset managers to invest their time in performance optimization, rather than techie tasks

The world of CRE investing is fast-paced and ever-changing. That’s why when asset managers spend large portions of their day collecting and organizing data from Property Management Companies (PMCs), Joint Ventures (JVs), Operating Partners (OPs), borrowers, and internal teams, their attention is divided. We understand this challenge, which is why we created created Data Management Services and Middle Office Services to reclaim valuable time.

Securing your data is our top priority

At Pereview, we prioritize your data security with rigorous encryption protocols including SOC2 Type II attestation, role-based access controls, and comprehensive training on user access management, ensuring your trust is our top priority throughout our seamless onboarding and support processes.

CRE real estate portfolio and asset management best practices and insights

Why co-sourcing is rising – and how a unified data platform solves the accuracy, workflow, and communication challenges between GPs and fund administrators. Outsourcing fund administration has become standard

The rise of the modern private markets CFO: From financial steward to strategic operator

Why the CFO role is expanding, and how data, automation, and middle-office modernization are defining the next era of leadership. Private markets are experiencing one of the most

As liquidity tightens and hold periods extend, lenders are demanding cleaner, faster, more defensible data – and most firms aren’t ready The private markets liquidity landscape is changing. Traditional exit timelines have slowed, rates remain elevated, and

Debt as an asset: Navigating refinancing risk and opportunity in 2026

CRE’s “tale of two debt markets” is unfolding – and data visibility will decide who benefits. According to Deloitte’s 2026 Commercial Real Estate Outlook, the debt markets are splitting in