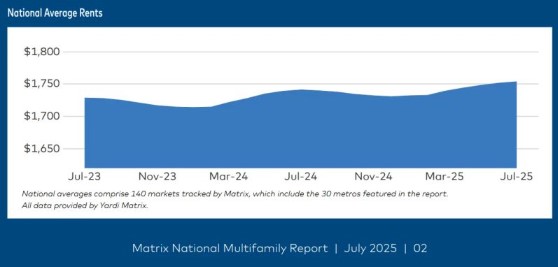

U.S. multifamily rents rose by $2 in July to $1,754, keeping annual growth steady at 0.7%, according to Yardi Matrix’s latest National Multifamily Report. That rate has stayed between 0.5% and 1.1% for nearly two years.

Demand remains strong, with over 300,000 units absorbed through June — on pace for the highest annual total since 2021. Occupancy held at 94.7% for the fourth straight month, even with 1 million units under construction, half in pre-leasing.

Regional trends diverge: Chicago (+4.1%), Columbus (+3.9%), and Detroit (+3.5%) lead growth, along with gains in New Jersey and San Francisco. In contrast, high-supply Sun Belt metros like Austin (-4.6%), Denver (-3.9%), and Phoenix (-2.8%) are still seeing rent declines.

Yardi projects that slower deliveries in the coming quarters could ease supply pressure and support stronger growth by late 2025. Solid job gains and easing tariff concerns are also contributing to a more favorable outlook.

Read a deeper dive from CRE Daily here.