2026 will separate firms experimenting with AI from those generating real results. The difference is data readiness

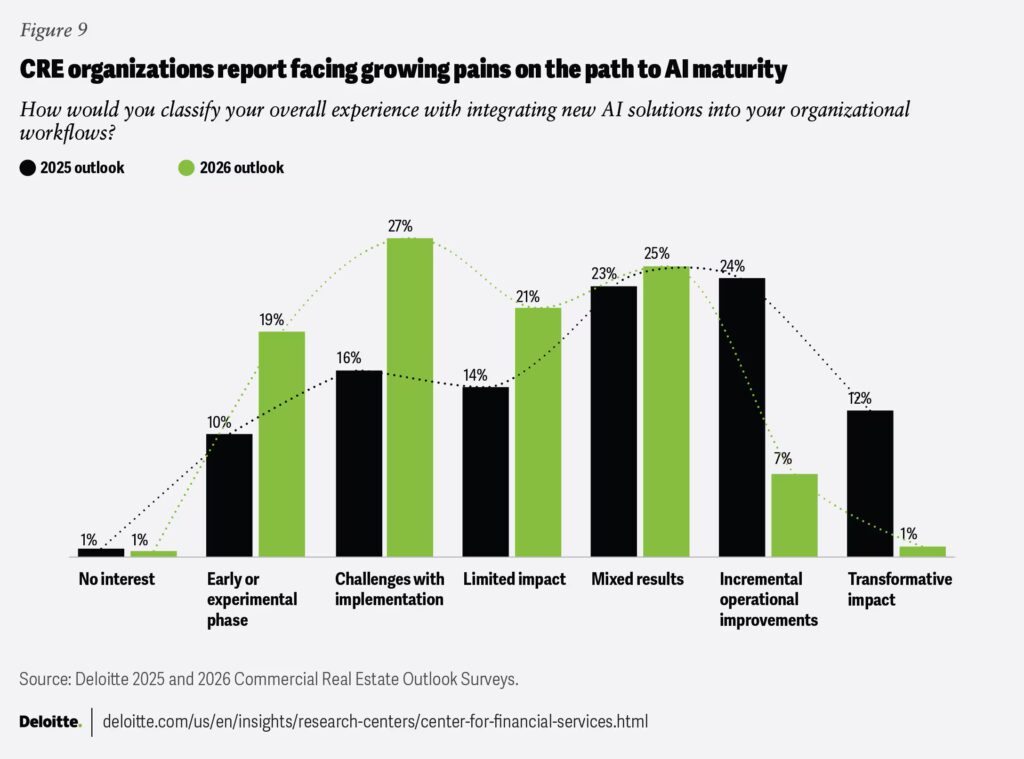

In Deloitte’s 2026 Commercial Real Estate Outlook, nearly one in five leaders said their firm is still in the early stages of AI adoption, and more than a quarter report challenges like lack of expertise, integration issues, or resistance to change.

That gap isn’t necessarily about ambition. It’s about application readiness.

Many firms have plenty of data, but it’s scattered across accounting systems, property portals, Excel models, and shared drives. The data isn’t standardized, verified, or structured for AI to interpret.

Before AI can deliver insights, your data has to be organized, comparable, and trusted. That’s where Pereview helps.

Why data readiness is the foundation of AI success

AI doesn’t eliminate manual work unless it’s fed clean, consistent data. And it can’t generate reliable insights if each portfolio, fund, or asset uses different metrics or naming conventions.

Pereview makes data AI-ready by:

- Centralizing operational and financial data from every source – Yardi, MRI, RealPage, Juniper Square, spreadsheets, and shared drives.

- Standardizing chart of accounts, financial metrics, and property-type taxonomies so all analyses are apples-to-apples.

- Validating and reconciling data through automated workflows managed by real estate accounting experts.

- Documenting every change and version to ensure audit-ready traceability.

Once that foundation is in place, firms can safely layer AI across ingestion, reporting, and analysis.

Practical AI use cases delivering ROI today

1. AI-powered document ingestion

Pereview uses AI to classify and extract data from rent rolls, loan documents, and leases – turning unstructured files into usable fields in minutes instead of hours.

2. Variance detection and workflow automation

AI can identify anomalies in budgets, actuals, or valuations and automatically routes variance notes or exceptions to the right team for review.

3. Reporting automation and ad-hoc analysis

Embedded Power BI in Pereview enables dynamic visualizations that update as soon as new data arrives with no more need to export or rebuild dashboards. eadsheets with real-time portfolio intelligence, asset managers can act before the market fully prices in the next shift.

Avoiding the AI hype trap

Deloitte notes that many organizations are moving away from broad, hype-driven AI pilots and instead are focusing on targeted, domain-specific use cases that produce measurable results.

That’s the Pereview approach: AI that supports business workflows instead of overshadowing them.

- Explainable outputs: Every AI-driven recommendation can be traced back to the underlying data.

- Human oversight: Users approve, validate, or correct AI-extracted information within the platform.

- Governed change logs: Each modification is tracked for compliance, Sarbanes Oxley, and audit purposes.

AI doesn’t replace expertise. It amplifies it. Pereview’s role is to make your asset managers faster, not redundant.

Building an “AI-ready” culture

Beyond the technology itself, the real differentiator is how quickly teams can adopt and trust AI-enabled workflows.

A few quick wins that can help drive long-term success with AI:

- Educate teams on how AI and automation fit into their daily processes (leasing, budgeting, variance tracking).

- Pilot small models – for example, document ingestion or variance detection – before scaling to portfolio forecasting.

- Measure impact with KPIs like time-to-report, data validation speed, and model accuracy over time.

Pereview’s AI-powered platform already integrates these practices so adoption feels natural, not disruptive.

The bottom line

AI can’t and won’t transform CRE firms that can’t trust their own data. Deloitte’s findings make that clear.

With Pereview, firms go from fragmented spreadsheets to a unified, standardized data ecosystem – where AI actually delivers measurable results: faster reporting, fewer errors, and more confident decisions.