By now, you know the story: Excel is an incredible modeling tool, but a terrible database.

If you’ve read our previous posts in this series about breaking free from error-prone Excel dependencies, you’ve seen our take on how firms struggle with fragile, disconnected spreadsheets, time spent tracking down #REF errors, and potential miscalculations. We’ve also explored why relying on Excel for reporting and data management creates inefficiencies that slow down decision-making and add unnecessary risk.

But here’s the good news: You don’t have to abandon Excel. You just need a better way to use it.

REF! errors and manual reporting

Let’s get specific. What does Excel Hell actually look like inside a real estate investment firm?

- #REF! errors spreading across reports: When spreadsheets link to dozens of others, one renamed file or broken formula can cause cascading errors, requiring hours of manual fixes.

- Hours (or days) wasted on manual data entry: Instead of focusing on investment strategy, teams spend countless hours updating and reconciling spreadsheets before reporting deadlines.

- Inconsistent and outdated data: When there’s no single source of truth, different teams pull data from different spreadsheets, leading to misaligned numbers and last-minute corrections.

- Missed opportunities: Slower reporting means slower decisions. If you’re spending your time wrangling data instead of analyzing it, you’re missing chances to optimize your portfolio.

Breaking free: How Pereview connects Excel to a centralized database for commercial real estate equity and debt assets

We’re not here to take Excel away from you. We’re here to make it work smarter.

With Pereview, you don’t have to choose between the flexibility of Excel and the structure of a database. You can have both.

Here’s how it works:

- Seamless two-way integration: Pereview connects your Excel models directly to a secure, centralized database, allowing you to push and pull data in real time.

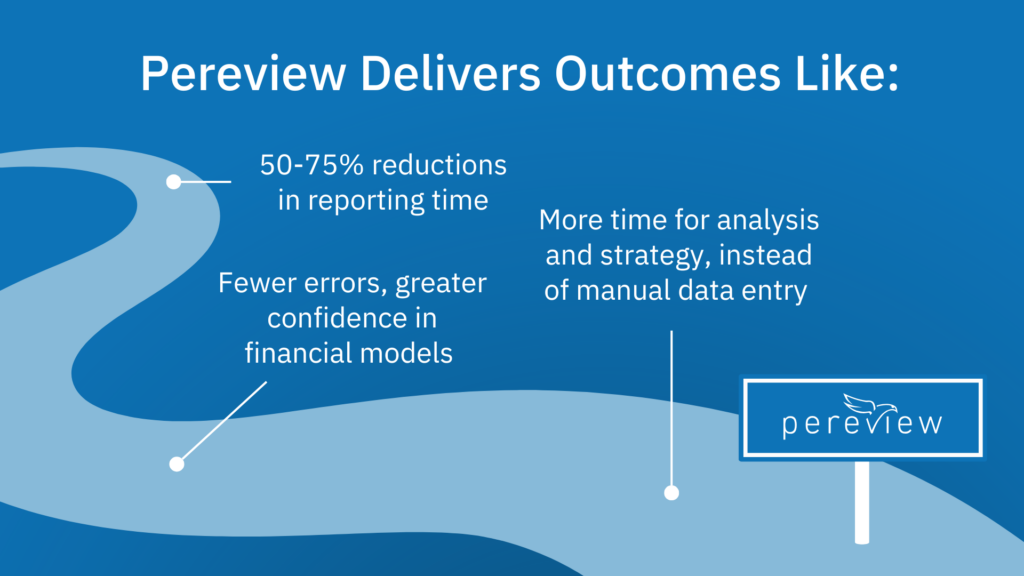

- Automated reporting: Stop manually updating spreadsheets. Pereview standardizes and automates complex reports, saving your team hours or even days every quarter.

- Eliminate #REF! errors forever: No more broken links, no more version control issues. Your data is always accurate, always up to date.

“We now spend more time doing deeper investment analysis, allowing us to drive value creation across our portfolio versus spending time updating many Excel files. We’ve been able to support the growth of our platform and materially increase portfolio analytics capacity without having to grow the team significantly.” – Max Gaglliardi, Chief Investment Officer, Dalfen Industrial

From fixing spreadsheets to making smarter decisions

When Excel is integrated into a structured, centralized system, reporting becomes effortless. Instead of fixing broken formulas and hunting down files, your team can focus on what really matters – making informed investment decisions.

Schedule a demo to see firsthand how you can get the best out of your Excel modeling with Pereview.