When growth slows, efficiency becomes your competitive edge.

Deloitte’s 2026 Commercial Real Estate Outlook revealed a subtle but important shift:

- Fewer firms plan to increase spending on technology or operations.

- Yet most expect revenues and expenses to rise in the next 12-18 months.

- Nearly 70% anticipate higher operating costs, but are still expected to deliver more.

That’s not a contradiction; it’s a mandate for operating excellence – achieving more output, accuracy, and insight with the same (or fewer) resources.

In practical terms, CRE organizations are realizing that efficiency isn’t a cost-cutting exercise. It’s a performance strategy.

Why efficiency and excellence now go hand in hand

Higher interest rates and selective capital deployment mean every basis point matters. The firms succeeding in this environment have one thing in common: data discipline.

They know exactly what’s happening across assets, loans, tenants, and funds – because their data isn’t scattered across systems.

That visibility allows them to:

- Close books faster with fewer errors.

- Spot and address variances before reporting deadlines.

- Make hold-sell or refinance decisions confidently.

- Deliver investor and lender reports automatically – without chasing spreadsheets.

That’s what operating excellence looks like in practice, and it’s what Pereview was built to enable.

How Pereview drives operating excellence

1. Eliminate manual data wrangling

AI-powered ingestion pulls rent rolls, trial balances, and loan documents into Pereview and standardizes the data automatically. Teams spend less time copying and pasting and more time analyzing.

2. Connect Excel models without chaos

With Pereview’s two-way Excel model connection, asset managers can maintain their trusted models while syncing data back to a central source. No version confusion. No broken links.

3. Automate workflows from close to report

From quarterly closes to variance reviews, configurable workflows ensure every task is assigned, tracked, and documented.

4. Enable real-time ad hoc reporting in Power BI

Ad hoc reporting with Power BI built directly in Pereview give leaders live visibility into performance – no exports and no stale data.

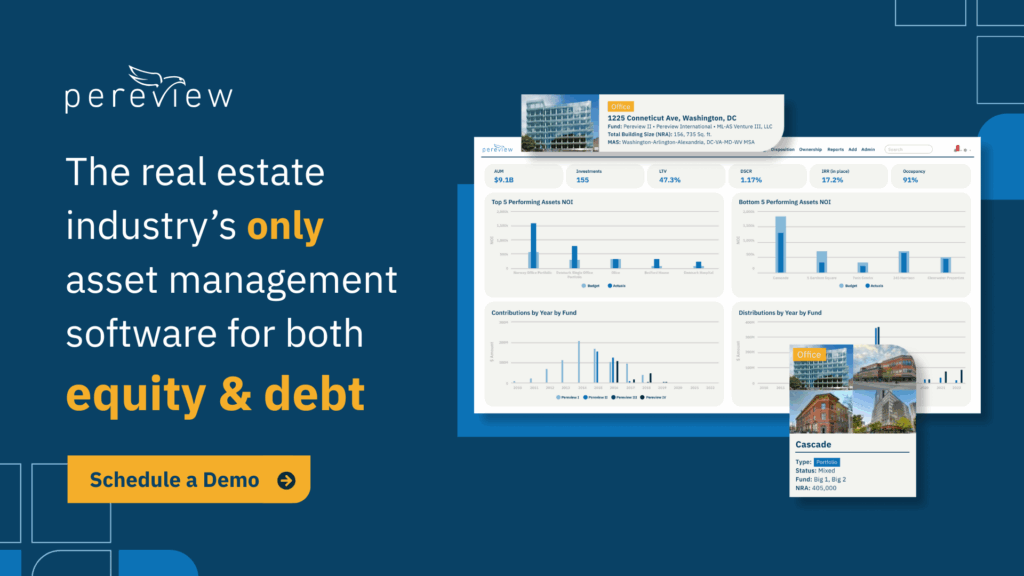

5. Integrate equity and debt views

Operating excellence extends to capital structure. Pereview brings together property operations, fund metrics, and loan performance, giving CFOs and CIOs a complete picture of every investment.

Scaling performance without scaling headcount

Operating excellence isn’t about adding analysts – it’s about multiplying impact.

Firms using Pereview’s integrated platform often report:

- Up to 90% faster month-end reporting

- Fewer reconciliation errors due to centralization and standardization

- Shorter decision cycles as portfolio data becomes self-serve

- Lower vendor overhead by consolidating multiple systems into one

That’s how you scale your team’s output without linear headcount growth.

Turning efficiency into advantage

As Deloitte notes, the early-mover advantage is fading. The next competitive edge will come from execution.

Pereview gives asset and portfolio managers the tools to act faster, validate data instantly, and respond to capital or market shifts with confidence.

When every firm has access to similar market data, operational excellence becomes the differentiator.

The operating-excellence checklist

To benchmark your firm’s readiness, ask:

- Can your team access current financial and operational data in one system?

- Are workflows automated from source to report?

- Do your Excel models stay in sync with accounting data?

- Can you compare budget vs. actuals vs. underwriting on demand?

- Are investor and lender packs generated automatically from the same data?

If you answered “no” to any of the above, you have an opportunity to simplify, standardize, and scale.

The takeaway

Operating excellence is no longer optional. It’s the price of admission in a capital-constrained market.

Pereview helps CRE organizations achieve it through data centralization, workflow automation, AI ingestion, and integrated reporting.

Schedule a demo to see how Pereview helps your team streamline operations, reduce risk, and focus on portfolio performance.