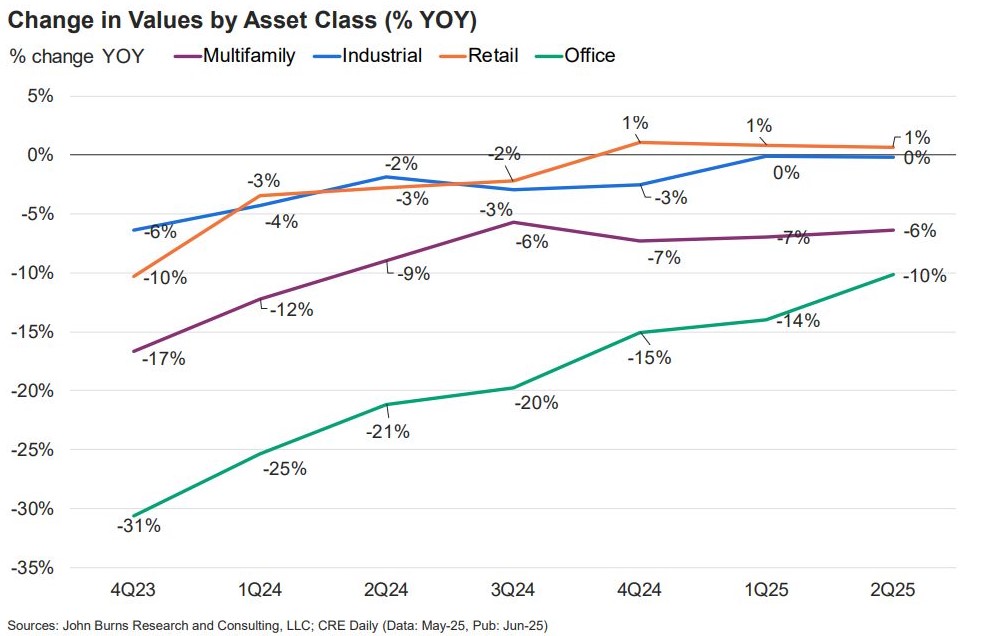

CRE Daily’s latest Q2 report shows a shifting landscape: Multifamily and Office values are still softening, but the rate of decline is easing. Meanwhile, Industrial is flat, but Retail continues its upward trend, delivering a third straight quarter of growth.

The takeaway? Sector performance is no longer moving in lockstep.

For asset managers, this kind of variability makes it even more critical to have a clear, real-time view across your portfolio. You need to know what’s happening, not just at the market level, but property by property, asset by asset.

That’s where Pereview comes in.

With Pereview, you get one centralized source of truth. Whether it’s occupancy trends, lease rollover risk, or NOI performance, the data is clean, connected, and always up to date. So instead of reacting late, you’re making decisions ahead of the curve.

Because in today’s environment, being accurate isn’t enough. You need to be early.

Read the full Q2 sector breakdown here.