Commercial real estate investment firms are looking to AI and automation for a competitive edge to power differentiation in 2024, according to PERE.

“Modeling and predictive analytics powered by AI use advanced algorithms to analyze vast amounts of data, ranging from market trends to tenant preferences, to identify investment opportunities that optimize asset performance,” PERE writes.

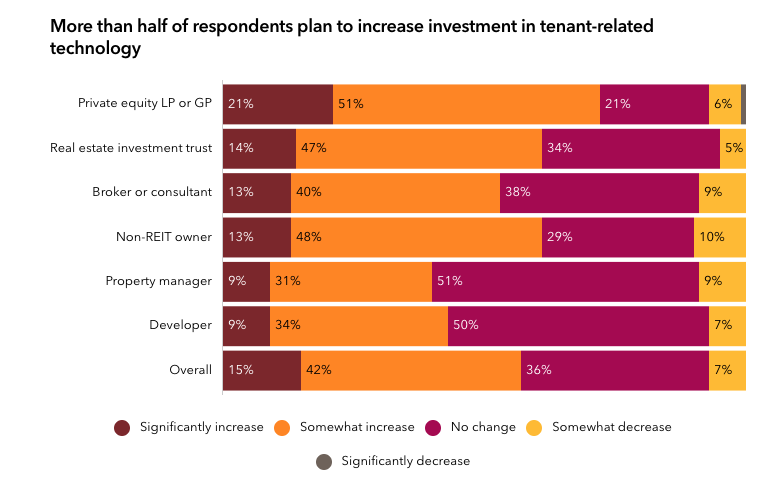

Real estate investors, Brokers, PMCs, and Developers are all committing to increase their investment in new IoT and wireless technologies according to data from a recent study by Deloitte.

Source: The Deloitte Center for Financial Services 2024 Real Estate Outlook Survey (via PERE)

This survey reflects how real estate investors are acknowledging and allocating their own investment in technologies such as:

- Data Analytics: Utilizing big data and advanced analytics to gain insights into market trends, property performance, and tenant behavior.

- Artificial Intelligence (AI): Implementing AI algorithms to automate processes, such as property valuation, predictive maintenance, and lease optimization.

- Virtual Reality (VR) and Augmented Reality (AR): Employing VR and AR technologies for property tours, visualization of development projects, and interactive tenant experiences.

- Internet of Things (IoT): Integrating IoT devices for smart building management, energy efficiency optimization, and enhanced security.

- Blockchain: Exploring blockchain technology for secure and transparent property transactions, digital ownership records, and smart contracts.

All with the goal of optimizing property management, improving tenant experiences, and making more informed investment decisions.

This opens the door for forward-thinking firms that are adopting new technologies to improve tenant-level like Pereview’s asset management platform. With AI-powered data aggregation, workflow automation, and the flexibility to empower CFOs, asset managers, and portfolio managers alike to better manage their business with a unified asset management platform.

These CRE firms using Pereview realize specific business outcomes like:

- Streamlining data aggregation

- Automating repetitive tasks like asking PMCs for rent roll data

- Instantly comparing budget to actuals and actuals to budgets without having to manually update data using Pereview’s ability to connect XLS models

- Extending the platform to third parties to enter data directly

- Visualizing risk across the portfolio, and more.